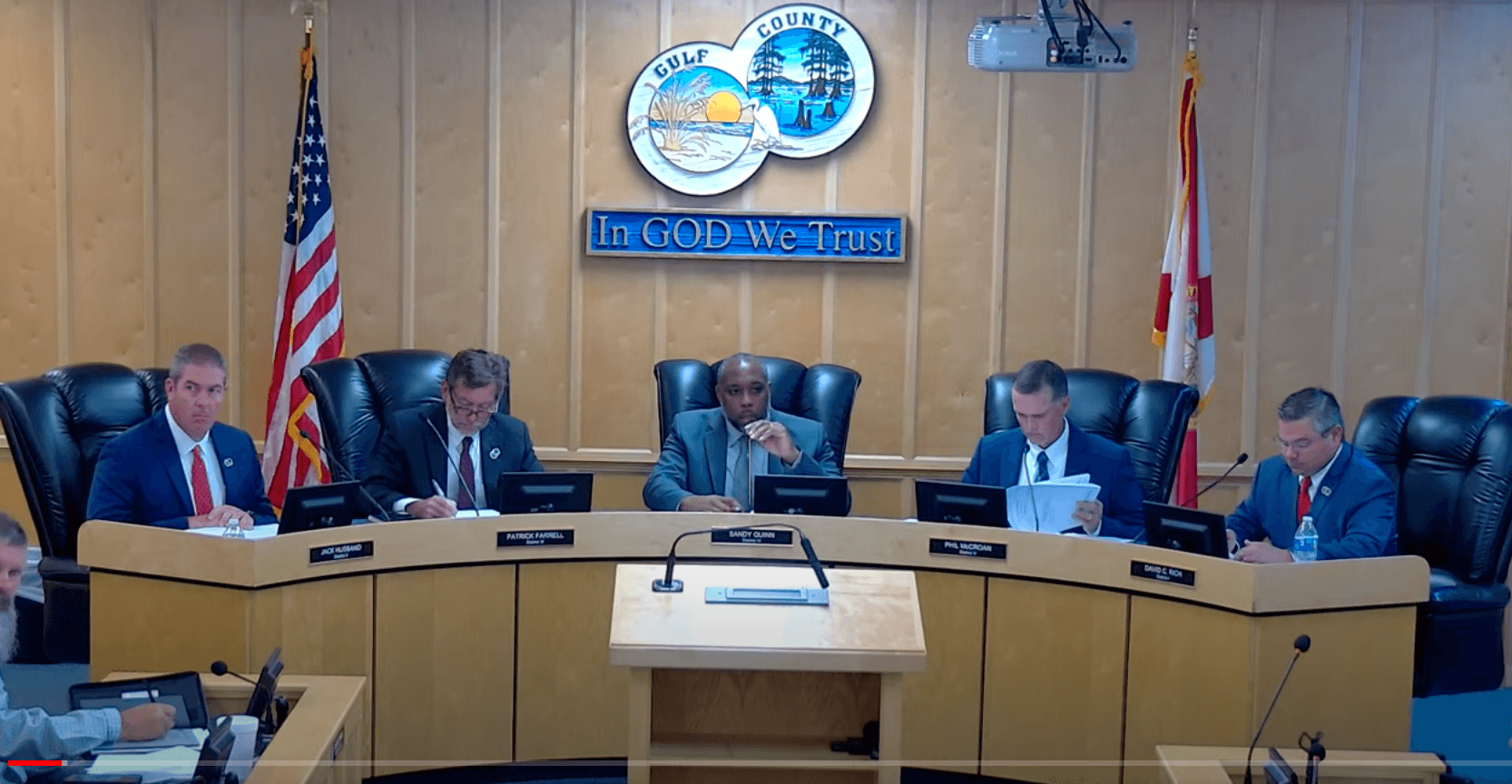

County adopts largest ever budget for upcoming fiscal year

Gulf County’s commissioners unanimously approved an $107 million budget for the upcoming fiscal year on Monday that will see a drop in the millage rate for the fourth year in a row.

The county’s aggregate millage rate going into the next year will be 6.5883 mills. But although this rate is lower than it was the year prior, the county still expects to bring in more tax money.

This rate is more than 11 percent higher than the rollback rate, meaning the county expects to bring in an additional $2.95 million in ad valorem tax funding.

“This is 11.55% above the current year aggregate rollback rate of 5.9064,” said Sherry Herring, the county’s budget director. “The tentative aggregate millage rate is made up of 6.2 mills countywide. 0.5 mills for the dependent fire districts, that’s St. Joseph, Tupelo, Overstreet and Howard Creek, and the MSTU voted debt service millage rates at gulfside beachfront for 0.50022, gulfside interior at 0.4758 and bayside at 0.4706.”

These were the maximum millage rates that could be adopted by the county in accordance with the tentative millage rate set by the commissioners in July. After tentative millage is set, it cannot be raised during further budgeting processes, though it may be lowered.

The rollback rate, or the millage rate needed to bring in the exact same amount of money as the year prior, is calculated using the total county property after reassessment by the Gulf County Property Appraiser’s office.

This means that those whose property values have increased since last year will end up paying more in taxes, even if the rate is lower. But the increased value of individual properties does not account for all increases in overall property values, largely due to increased competition for home sales.

“Both new listing and total listings have dropped from this time last year, and that fuels homebuyer competition in some markets and keeps homes prices from falling further,” Property Appraiser Mitch Burke said in June, following his annual evaluation. “Right now, nearly every U.S. homeowner, should they sell and purchase another home, will move into a higher mortgage rate. As a result, those people that don’t have to sell won’t. That’s why pending home sales nationwide are down about 17% from a year ago.”

This year’s taxable value is the highest Gulf County has ever recorded.

Gulf County’s preliminary taxable value of $3,066,307,241 is 22.58 percent higher than in 2022 and 50.3 percent higher than in 2021. It is 76.33 percent higher than the preliminary taxable value from 2018, prior to Hurricane Michael, which greatly diminished local property values.

It also surpasses 2008 (the county’s previous high) by $166.29 million, or 5.78%.

According to Herring additional funding will be allocated to several county projects and expenditures in the upcoming year.

“The primary reasons for the ad valorem tax revenue increasing,include FRS retirement costs, insurance costs, pay raises, capital outlay, sheriff’s office services, county services, jail services, EMS and 911 services,” she told the board.

County Administrator Michael Hammond said that the county’s ability to lower their millage rate resulted, at least in large part, from a 2018 decision made by the board to eliminate CRAs in the county.

“If you pay attention to what’s going on in Bay County, they’ve raised taxes substantially this year because the CRAs have taken such a huge chunk,” he said. “That 2018 decision by the board was massive, and you’ve gotten to see some of the benefit this year. That decision’s already paid for itself. It’s a benefit to all the taxpayers because everybody shares in the cost of the jail, and fire departments, and EMS and whatnot, instead of just a few.”

The fiscal year 2023-24 budget will go into effect on Oct. 1.

Meet the Editor

David Adlerstein, The Apalachicola Times’ digital editor, started with the news outlet in January 2002 as a reporter.

Prior to then, David Adlerstein began as a newspaperman with a small Boston weekly, after graduating magna cum laude from Brandeis University in Waltham, Massachusetts. He later edited the weekly Bellville Times, and as business reporter for the daily Marion Star, both not far from his hometown of Columbus, Ohio.

In 1995, he moved to South Florida, and worked as a business reporter and editor of Medical Business newspaper. In Jan. 2002, he began with the Apalachicola Times, first as reporter and later as editor, and in Oct. 2020, also began editing the Port St. Joe Star.