County plans to lower millage rate in 2023-24

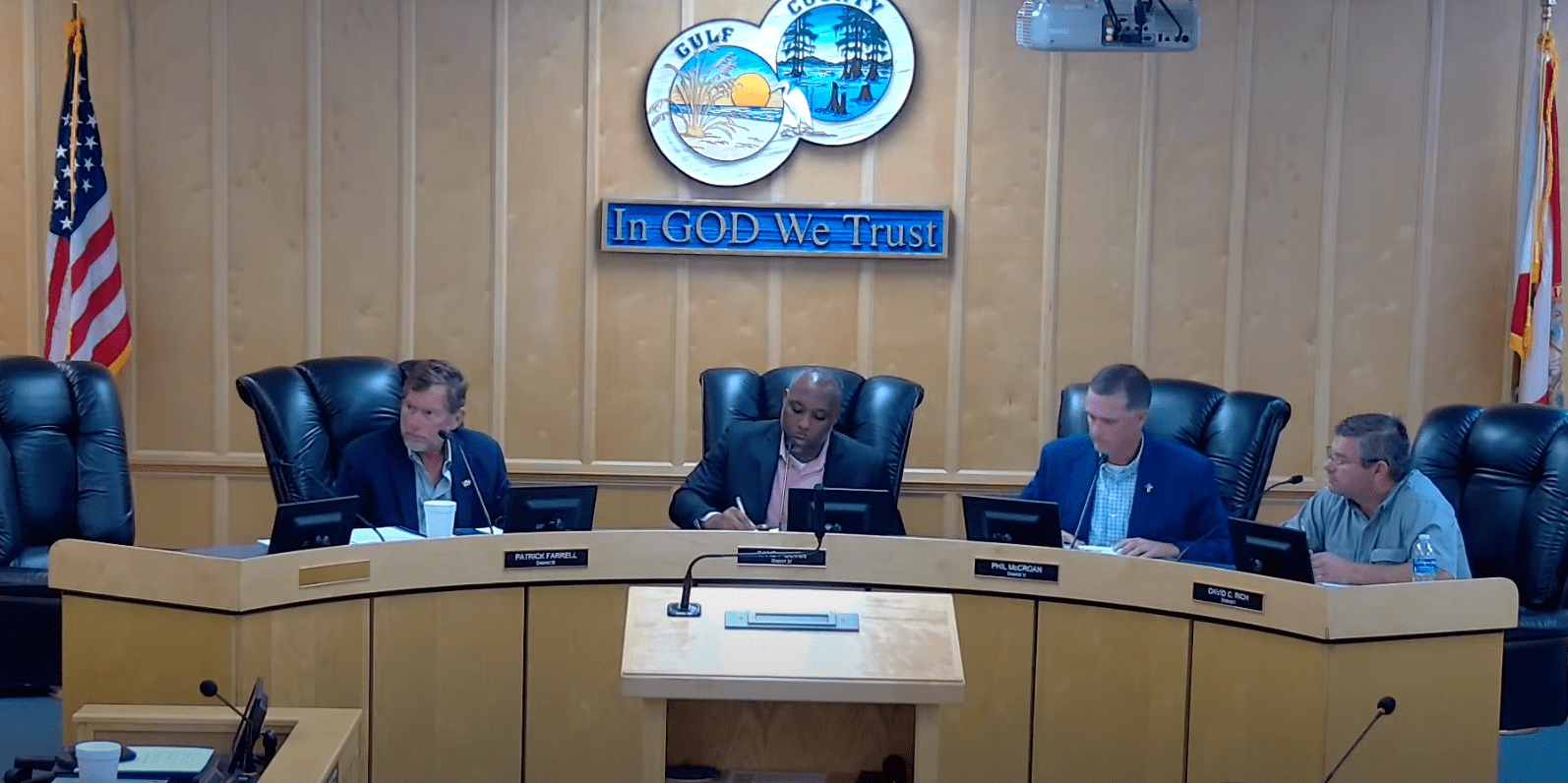

Gulf County commissioners last week unanimously approved a budget proposal for the upcoming fiscal year that will see a drop in the millage rate for the fourth year in a row.

At a special meeting July 17, the commissioners voted to lower the 6.5-mill county-wide levy to 6.2 mills, and still raise about $19 million for the general fund, about $3 million more levied in new monies.

The tax levy to fund the county’s four fire districts remains unchanged at a half-mill and will bring in an additional $1.2 million for the general fund. County municipal service taxing units are expected to see a significant reduction, bringing in a total of $400,000.

“The bottom line number is pretty staggering,” said County Administrator Michael Hammond at the meeting. “I think my first budget was $43 (million). Your proposed budget this year is $103,298,895.”

However, Hammond added a caveat after announcing this total number, sharing that final state revenue numbers had yet to be received by the county.

“We have not received the final state numbers,” he said. “… Every county has a certain timeline that starts July 1, and most counties have to have the budget to you by July 15, and you have to certify it to the property appraiser by August 4 in most years. It’s impossible for counties to accurately put together a good budget if we don’t have state revenues estimated by July 15 at the latest… but we do not, so (the director of the office of budget management) has done her best to estimate the state shared revenues portion.”

This year’s taxable value is the highest Gulf County has ever recorded, according to Property Appraiser Mitch Burke.

At $3,066,307,241, it is 22.58 percent higher than in 2022 and 50.3 percent higher than in 2021. It is 76.33 percent higher than the preliminary taxable value from 2018, prior to Hurricane Michael, which greatly diminished local property values.

In a motion made by Commissioner Patrick Farrell and seconded by Phillip McCroan, the board unanimously voted to move forward with the budgeting process, allowing changes to be made as additional numbers come in in the coming weeks.

The board set a firm date for the final budget’s first reading on September 9 at 5:01 p.m. EDT.

What’s in the county’s proposed 2023-24 budget?

Overall ad valorem taxes (including MSTUs and fire districts) — $20.601 million

Local option fuel tax — $6.520 million

Other general taxes — $96,000

Permits, fees and special assessments — $777,000

Federal grants — $2.981 million

Federal payments in lieu of taxes — $1,200

State grants — $6.8 million

State shared revenues (estimation) — $4.8 million

State payments in lieu of taxes — $6 million

Charge for services — $6.365 million

Fines — $9,000

Miscellaneous revenue — $350,000

Cash Carry Forward — $48.559 million

Meet the Editor

David Adlerstein, The Apalachicola Times’ digital editor, started with the news outlet in January 2002 as a reporter.

Prior to then, David Adlerstein began as a newspaperman with a small Boston weekly, after graduating magna cum laude from Brandeis University in Waltham, Massachusetts. He later edited the weekly Bellville Times, and as business reporter for the daily Marion Star, both not far from his hometown of Columbus, Ohio.

In 1995, he moved to South Florida, and worked as a business reporter and editor of Medical Business newspaper. In Jan. 2002, he began with the Apalachicola Times, first as reporter and later as editor, and in Oct. 2020, also began editing the Port St. Joe Star.