County expected to pay 50 percent more for property insurance in upcoming fiscal year

According to the county’s insurance company, the county government should expect their property insurance rate increase by as much as 50 percent in the next fiscal year.

The jump is the result of increased property values statewide, as well as a worsening crisis among insurance providers, who claim frequent lawsuits limit their coverage abilities.

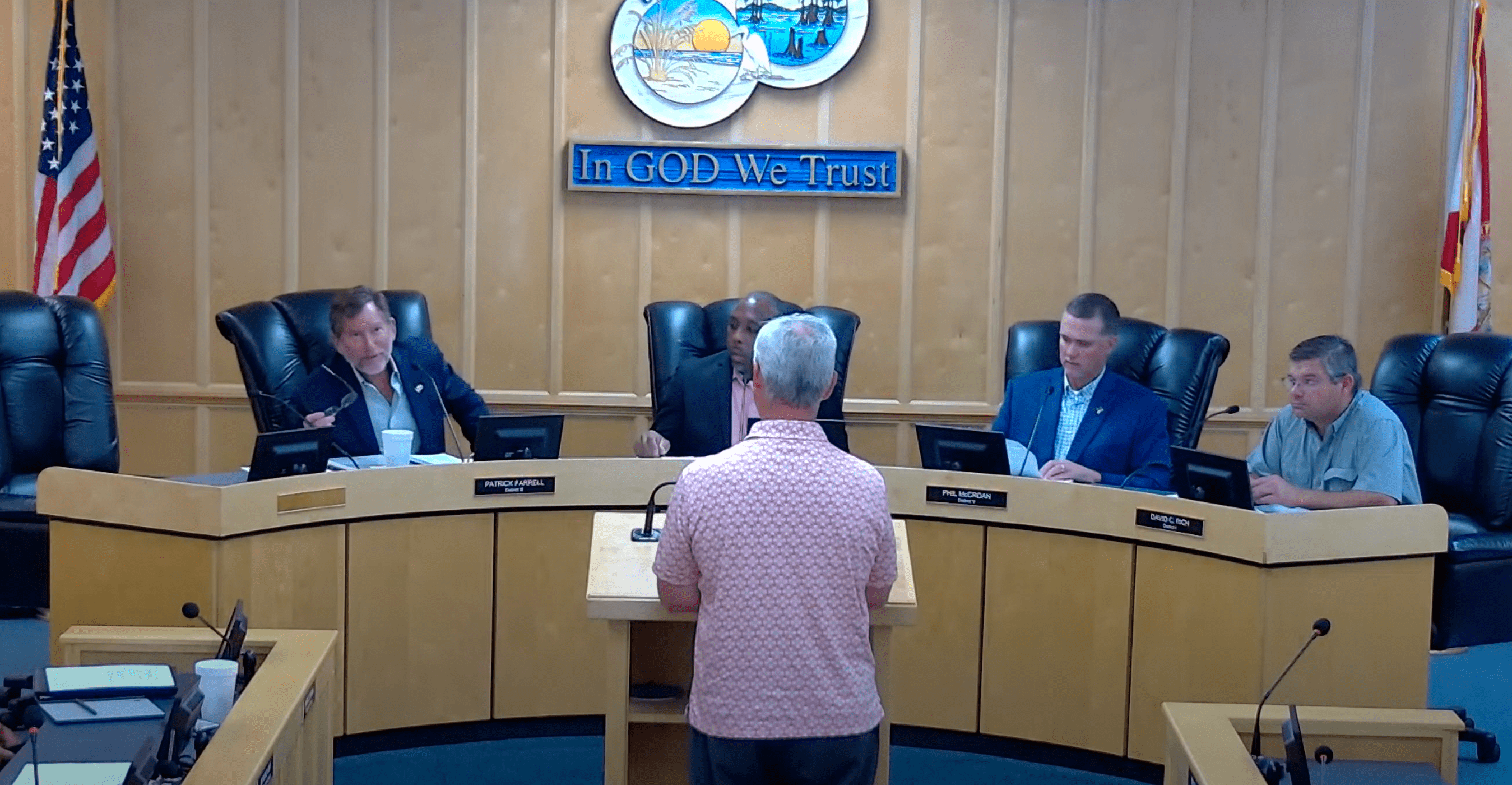

“I’ve been communicating with the administrator and with staff that we would probably expect about a 50 percent increase in the property premium,” said Dwight Van Lierop, a representative from Acentria Insurance. “Unfortunately, that is the state of the market right now.”

“…The other markets — as far as liability, workers comp., those things — they’re pretty stable… It’s the property market that’s killing us.”

The increase in insurance rates is not unlike those being seen by homeowners statewide, Van Lierop pointed out, and it is rooted in similar causes.

“You all can probably see it in your own personal lives,” he said. “Whether it’s your business’s insurance or whether it’s your individual family coverages, you’re probably feeling some of that same pain right now.”

Households in Florida, the third most populous state in the US, have been grappling for some time with a property insurance crisis that is making home ownership unaffordable for many. After at least six insurers went insolvent in Florida last year, Farmers on Tuesday became the latest to pull out of the Florida market, saying in a statement that the decision was based on risk exposure in the hurricane-prone state.

In the past 18 months, 15 property insurers have ceased business in the state, causing a lack of competition that results in higher premiums for floridians. These companies often claim their motivation to leave the state rests with a high number of lawsuits they had to litigate after events causing a large number of filings, such as hurricanes.

Florida represented 82 percent of all litigation of insurance in the United States last year.

Average annual property insurance premiums had risen to more than $4,200 in Florida by the end of 2022—triple the national average.

But name and county officials say they are hopeful recent measures passed by the state legislature will bring relief in the coming years.

Earlier this year, the state house of representatives and state senate passed measures that were largely aimed at reducing the number of lawsuits faced by insurance companies in the state in an attempt to prevent rapidly rising premiums and insurer insolvencies.

The effects of these policies, if effective, won’t be seen any time soon, however, Van Lierop said.

“As a result of some of the measures the Florida legislature passed, within about an 18-month to two year period of time, everyone is expecting it to have a trend downward on rates,” he said.

Meet the Editor

David Adlerstein, The Apalachicola Times’ digital editor, started with the news outlet in January 2002 as a reporter.

Prior to then, David Adlerstein began as a newspaperman with a small Boston weekly, after graduating magna cum laude from Brandeis University in Waltham, Massachusetts. He later edited the weekly Bellville Times, and as business reporter for the daily Marion Star, both not far from his hometown of Columbus, Ohio.

In 1995, he moved to South Florida, and worked as a business reporter and editor of Medical Business newspaper. In Jan. 2002, he began with the Apalachicola Times, first as reporter and later as editor, and in Oct. 2020, also began editing the Port St. Joe Star.